MONEY MANAGEMENT (also popularly called "POSITION SIZING") *

When I started trading many years ago my focus was on making the maximum profits, and things like money or risk management was boring stuff to me that I did not spend any time with. Now if you make such cardinal mistakes in Forex as these, you can have a hard taskmaster, and sooner or later you will have to learn your lesson. Today my focus is on risk control (remember the Golden Rule in my class?). As few and as small losses as possible. And one thing that supports that approach is, of course, money management, which looks after one part of this rule, i.e. small as possible losses. In other words: "Live to trade another day!". I now want to expand a little on how mangement is properly done. There are many different approaches on this subject, and on my website you will find some complicated scientific methods, but I am going to give you a simpler approach that will give you 90% of the benefits. Once again it will take time for you to become an expert on this - because it takes a lot of practical experience to achieve the level of profesional traders.

Definition:

Money management (or position sizing) is all about varying your volume / lot size / position size on a trade according to the amount of money available to you, the volatility of the market / currency pair, and your risk appetite to achieve maximum profit within acceptable manageable risk.

On the one hand, money management limits the size of your losses to an acceptable level, so that you can bear a series of losses and not damage your account too much. You will always experience losses in Forex trading and sometimes there can be an unusual situation where you can have a very long series of losses in a row. If you want to survive this, or at least not suffer too much anxiety when you are having losing trades, you must limit your losses based on a maximum percentage of your equity or balance that you have available. Some traders base this percentage rather on the available free margin they have for trading, in order to be more accurate.

On the other hand, you will want to maximise your profit within accepatble risk by increasing your volume / lot size / position sizing on better quality trades, and reduce it on higher quality trades. Your next question is going to be: "Now when is a trade a quality trade?" Damn! I was hoping you would not ask that question! It is tricky - and yes it takes a lot of experience to get it right properly - but here is an attempt:

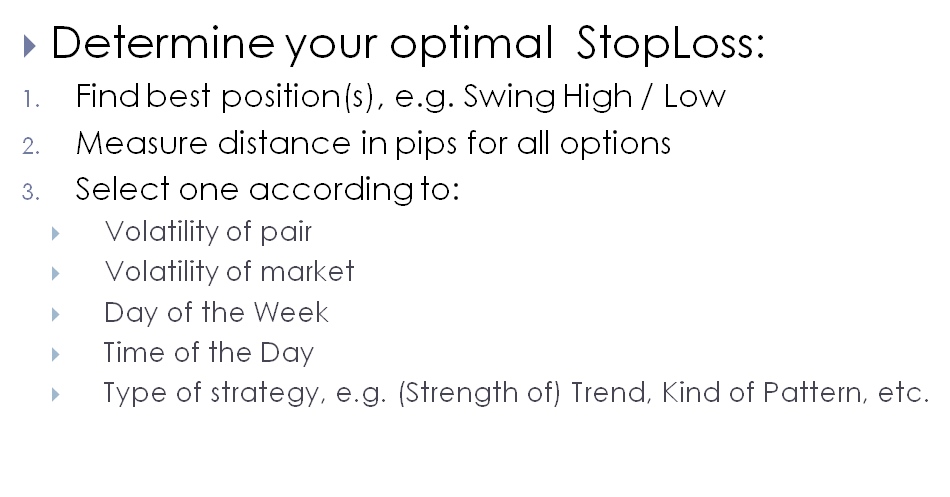

- A quality trade can be judged by a healthy Risk:Reward situation. The correct position size is heavily depended on placing the optimal Stop Loss. This in turn will affect your Risk:Reward that is achieveable with this trade, and the better your Risk:Reward the better the quality of the trade. Now this should not depend on hope and prayer or on a gambling spirit, but on as much scientific data that is available to make a correct decision. The size of your Stop Losses is determined by volatility (depended on ADR of currency pair, market price action, day of the week, time of the day, etc.), time frame (lower time frames require smaller S/L e.g. with M15 a 30 pips S/L is normal, but in a H1 time frame we look more for something like 50+ pips) and type of system or trade. E.g if you trade a correction/retracement that moves back in the direction of a strong trend your Risk:Reward could be 1:3 or more, but if you trade a breakout of a channel your Risk:Reward will be around 1:1 only. In general, the smaller a "SAFE" Stop Loss can be in relation to the volatility, the better the Risk:Reward that can be achieved.

- A better quality trade can also be defined as a trade that has proved to move in the right direction. So when shortly after opening the trade it moves into a profit situation that grows bigger with time we have identified a better quality trade. This is the environment where advanced traders use "scaling in" techniques, which means they add to their original position by opening more trades in that direction.

Then there is also the practice to "scale out" of a trade, by taking some profit at certain stages while letting the rest run for hopefully better profits.

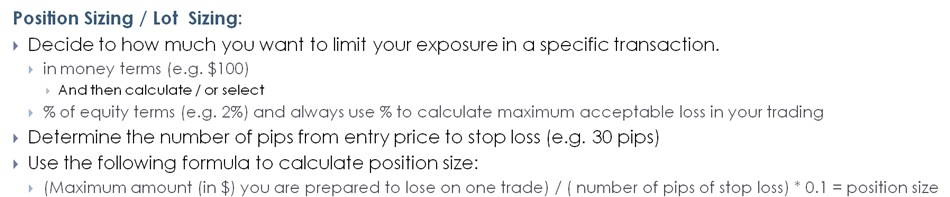

To simplify things for beginner traders we focus on just four things:

- Calculating the lot size based on a maximum percentage of equity/balance/free margin available - and a well placed Stop Loss.

- Opening the trade with only 50% of the lot size calculated, and then adding the other 50% only after the trade has proven to move in the right/profitable direction.

- Closing the first (50%) trade at the first Profit Target, and the second one at the second larger Profit Target. (these targets will be based on the SR levels as taught in the course)

- Moving the S/L first to a breakeven position as the price goes in the right direction and pierces the first SR level, and then to the first Profit Target level when the price appeoaches the second Profit Target, and so on.

The next question may be: "What is an acceptable maximum risk percentage that I should base my trades on?"

Once again no simple straightforward answer. It depends a lot on how large a deposit you have with your broker and what your income needs are. Generally the larger the deposit the lower the risk percentage you have to take to generate the required income, e.g. if you have a deposit of $20,000 + you can trade at a 1% and even 0.5% percentage risk and still make a good income. But when you have e.g. only $2,000 deposit you may have to trade at a much higher risk percentage, maybe up to 5% to generate some kind of reasonable income. As a begnner trader I will advise that you not trade higher than 1 - 2% percentage and build up the size of your deposit to earn a better income in future.

Now I want to end by giving you again the formula (taken from my course) of how to calculate your lot size according to your maximum risk percentage that you want to trade with:

AND THEN:

E-mail: [email protected]